tax return

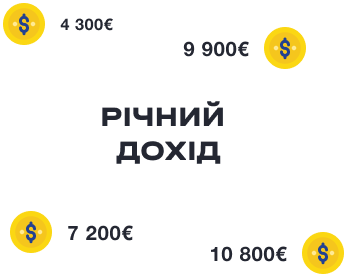

Average return amount

The smallest amount of tax refund is 275 euros. The largest in our experience is 1,650 euros.

This amount depends on many factors. You will find out the exact amount of the refund during the consultation - leave your contact information and we will contact you.

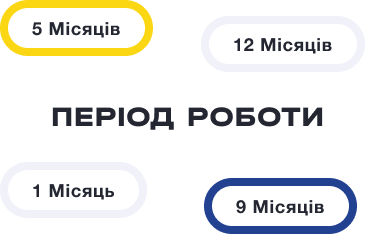

what depends

refund amount?

submission of documents

our reviews

customers

not found

what were you looking for?

When you officially work abroad, income tax is withheld from your salary in advance. At the end of the contract, the real amount of profit and tax on it are determined. It is here, in most cases, that the tax surplus appears, which you can return by submitting a declaration to the tax office.

When you officially work abroad, income tax is withheld from your salary in advance. At the end of the contract, the real amount of profit and tax on it are determined. It is here, in most cases, that the tax surplus appears, which you can return by submitting a declaration to the tax office.

When you officially work abroad, income tax is withheld from your salary in advance. At the end of the contract, the real amount of profit and tax on it are determined. It is here, in most cases, that the tax surplus appears, which you can return by submitting a declaration to the tax office.

When you officially work abroad, income tax is withheld from your salary in advance. At the end of the contract, the real amount of profit and tax on it are determined. It is here, in most cases, that the tax surplus appears, which you can return by submitting a declaration to the tax office.